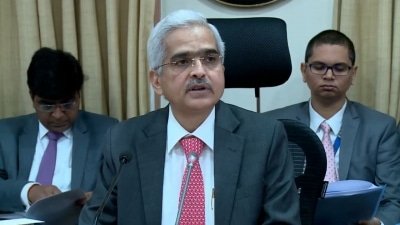

New Delhi, April 17 (IANS) Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday announced a 90-day extension for the resolution period for large stressed assets which have not been resolved within the 210 day deadline as per the central banks June 7, 2019 order.

Announcing a slew of liquidity and regulatory easing measures for financial institutions to tide over the coronavirus crisis, the RBI Governor also said that NPA classification will exclude the moratorium period.

Das noted that under RBI’s prudential framework of resolution of stressed assets dated June 7, 2019, in the case of large accounts under default, Scheduled Commercial Banks, AIFIs, NBFC-ND-SIs and NBFC-D are currently required to hold an additional provision of 20 per cent if a resolution plan has not been implemented within 210 days from the date of such default.

“Recognizing the challenges to resolution of stressed assets in the current volatile environment, it has been decided that the period for resolution plan shall be extended by 90 days,” Das said.

On March 27, 2020 the RBI had permitted lending institutions to grant a moratorium of three months on payment of current dues falling between March 1 and May 31, 2020.

He said that it is recognised that the onset of COVID-19 has also exacerbated the challenges for such borrowers even to honour their commitments fallen due on or before February 29, 2020 in Standard Accounts.

“It has been decided that in respect of all accounts for which lending institutions decide to grant moratorium or deferment, and which were standard as on March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there would an asset classification standstill for all such accounts from March 1, 2020 to May 31, 2020,” said the central bank governor.

–IANS

rrb/sn